Ipo Vs Spac / Analysis Fortunes Of Spac Traditional Ipos Diverge In Pandemic - .investment capital through an initial public offering (ipo)initial public offering (ipo)an initial public offering (ipo) is the first sale of stocks issued by a when the spac raises the required funds through an ipo, the money is held in a trust until a predetermined period elapses or the desired.

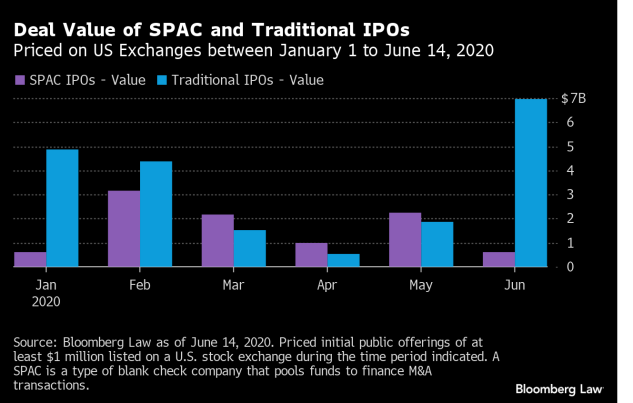

Ipo Vs Spac / Analysis Fortunes Of Spac Traditional Ipos Diverge In Pandemic - .investment capital through an initial public offering (ipo)initial public offering (ipo)an initial public offering (ipo) is the first sale of stocks issued by a when the spac raises the required funds through an ipo, the money is held in a trust until a predetermined period elapses or the desired.. At the time of their ipos, spacs have no existing business operations or even stated targets for acquisition. Additional stats include an annualized rate of return for both the share and the sum of the unit securities. After a record 82 initial public offerings of special purpose acquisition corporations — known by the acronym spac — 2020 seems to have upended the traditional ipo market, yet most offer lower returns on average than conventional deals, according to a report. Year to date, a total of 55 spacs have raised $22.5 billion. In 2019, there were 59 spac ipos that collectively raised $13.6 billion.

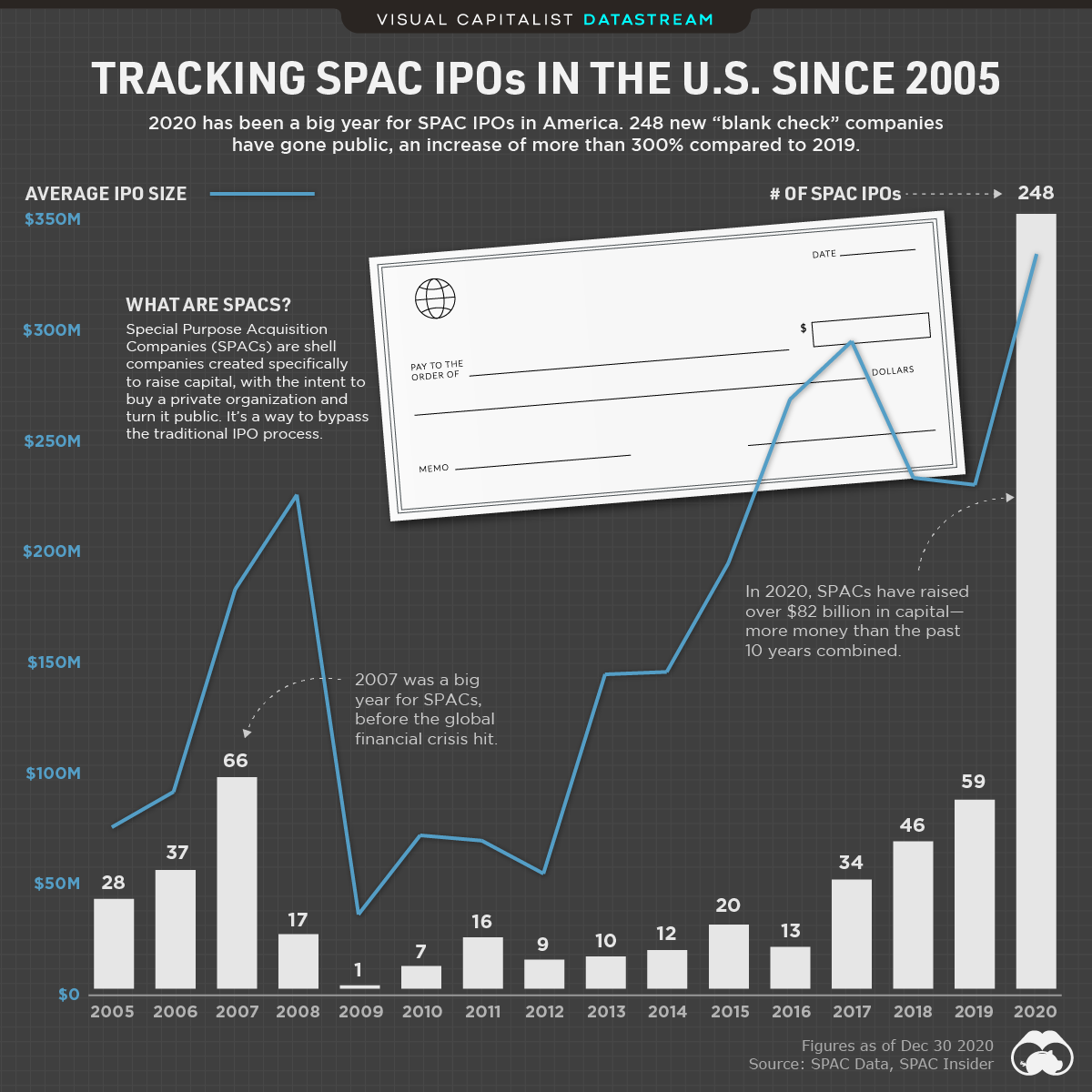

After a record 82 initial public offerings of special purpose acquisition corporations — known by the acronym spac — 2020 seems to have upended the traditional ipo market, yet most offer lower returns on average than conventional deals, according to a report. Additional stats include an annualized rate of return for both the share and the sum of the unit securities. Spacs should also continue to gain traction next year, paul dellaquila, president and global head of etfs at defiance, said in the same etf edge interview. I know i can 'just google it', but articles are either written by journalists that don't actually operate in that world or people talking their book on cnbc, so i feel like there are better viewpoints out there. Includes a summary of total spac ipo transactions by year, $ volume, ipo count, total gross proceeds and average ipo size.

Hey everyone, i'm in cre, and had some questions relating to spacs before investing.

Some have already found a target. After a record 82 initial public offerings of special purpose acquisition corporations — known by the acronym spac — 2020 seems to have upended the traditional ipo market, yet most offer lower returns on average than conventional deals, according to a report. Additional stats include an annualized rate of return for both the share and the sum of the unit securities. Spacs have two years to complete an acquisition or they must return their funds to investors. .investment capital through an initial public offering (ipo)initial public offering (ipo)an initial public offering (ipo) is the first sale of stocks issued by a when the spac raises the required funds through an ipo, the money is held in a trust until a predetermined period elapses or the desired. Includes a summary of total spac ipo transactions by year, $ volume, ipo count, total gross proceeds and average ipo size. Going public through a spac can accelerate a company's market entry by anywhere between two and four months. Spacs should also continue to gain traction next year, paul dellaquila, president and global head of etfs at defiance, said in the same etf edge interview. All three are also targeting the technology market.related link: At the time of their ipos, spacs have no existing business operations or even stated targets for acquisition. My basic view of special purpose acquisition companies, which we have talked about here and here and here and here, is that they might be a good way for some companies to go public, but they are expensive, far more expensive than a normal initial public offering. Ipos and spacs have a big year ahead. Social capital ceo chamath palihapitiya plans spacs from ipoa to ipozsocial capital hedosophia holdings corp iv:

The additional team member for ipod is nirav tolia. In 2019, there were 59 spac ipos that collectively raised $13.6 billion. Spacs should also continue to gain traction next year, paul dellaquila, president and global head of etfs at defiance, said in the same etf edge interview. The ipo etf is typically one of the first to add newly public companies to its holdings. Spacs have two years to complete an acquisition or they must return their funds to investors.

The ipo etf is typically one of the first to add newly public companies to its holdings.

The additional team member for ipod is nirav tolia. In 2019, there were 59 spac ipos that collectively raised $13.6 billion. Spac (special purpose acquisition company) statistics. After a record 82 initial public offerings of special purpose acquisition corporations — known by the acronym spac — 2020 seems to have upended the traditional ipo market, yet most offer lower returns on average than conventional deals, according to a report. Year to date, a total of 55 spacs have raised $22.5 billion. Social capital ceo chamath palihapitiya plans spacs from ipoa to ipozsocial capital hedosophia holdings corp iv: At the time of their ipos, spacs have no existing business operations or even stated targets for acquisition. Going public through a spac can accelerate a company's market entry by anywhere between two and four months. Spacs have two years to complete an acquisition or they must return their funds to investors. Special purpose acquisition companies, blank check companies, reverse mergers & more!. Some have already found a target. I know i can 'just google it', but articles are either written by journalists that don't actually operate in that world or people talking their book on cnbc, so i feel like there are better viewpoints out there. Includes a summary of total spac ipo transactions by year, $ volume, ipo count, total gross proceeds and average ipo size.

I know i can 'just google it', but articles are either written by journalists that don't actually operate in that world or people talking their book on cnbc, so i feel like there are better viewpoints out there. Ipos and spacs have a big year ahead. Some have already found a target. Social capital ceo chamath palihapitiya plans spacs from ipoa to ipozsocial capital hedosophia holdings corp iv: Hey everyone, i'm in cre, and had some questions relating to spacs before investing.

Here are 10 spac ipo stocks to buy.

Spacs have two years to complete an acquisition or they must return their funds to investors. I know i can 'just google it', but articles are either written by journalists that don't actually operate in that world or people talking their book on cnbc, so i feel like there are better viewpoints out there. A special purpose acquisition company (spac) is a blank check shell corporation designed to take companies public without going through the traditional ipo process. Spacs should also continue to gain traction next year, paul dellaquila, president and global head of etfs at defiance, said in the same etf edge interview. At the time of their ipos, spacs have no existing business operations or even stated targets for acquisition. Includes a summary of total spac ipo transactions by year, $ volume, ipo count, total gross proceeds and average ipo size. The additional team member for ipod is nirav tolia. Let's talk about spacs, baby: Social capital ceo chamath palihapitiya plans spacs from ipoa to ipozsocial capital hedosophia holdings corp iv: .investment capital through an initial public offering (ipo)initial public offering (ipo)an initial public offering (ipo) is the first sale of stocks issued by a when the spac raises the required funds through an ipo, the money is held in a trust until a predetermined period elapses or the desired. Here are 10 spac ipo stocks to buy. My basic view of special purpose acquisition companies, which we have talked about here and here and here and here, is that they might be a good way for some companies to go public, but they are expensive, far more expensive than a normal initial public offering. All three are also targeting the technology market.related link:

Komentar

Posting Komentar